ESG Library

Corporate Governance

Basic Approach

As the Group contributes to society, strengthening corporate governance is one of its priorities, thus it is making Groupwide efforts to establish effective internal control systems that are appropriately composed and managed, based on the DOWA Group’s Corporate Mission, Vision, Values, and Code of Conduct.

Promotion System

The Company employs a holding company structure that enables it to have a deeper grasp of customer needs at the ground level of the market and enables swift decisions to be made with authority. This structure also allows us to separate our core businesses into subsidiaries, which in turn facilitates more flexible and bolder management in accordance with the characteristics of each core business, and to allocate management resources to Group companies in an optimal manner, thereby working to maximize corporate value by realizing the sustainable growth of the Group. The Company is a company with an Audit & Supervisory Board. In addition, to speed up decision-making and improve efficiency, the Company has adopted an executive officer system and aims to improve the supervisory function of the Board of Directors by clarifying management responsibility by appointing nine directors (the maximum number of directors is 13) with a term of office of one year.

Board of Directors

Composition of the Board of Directors

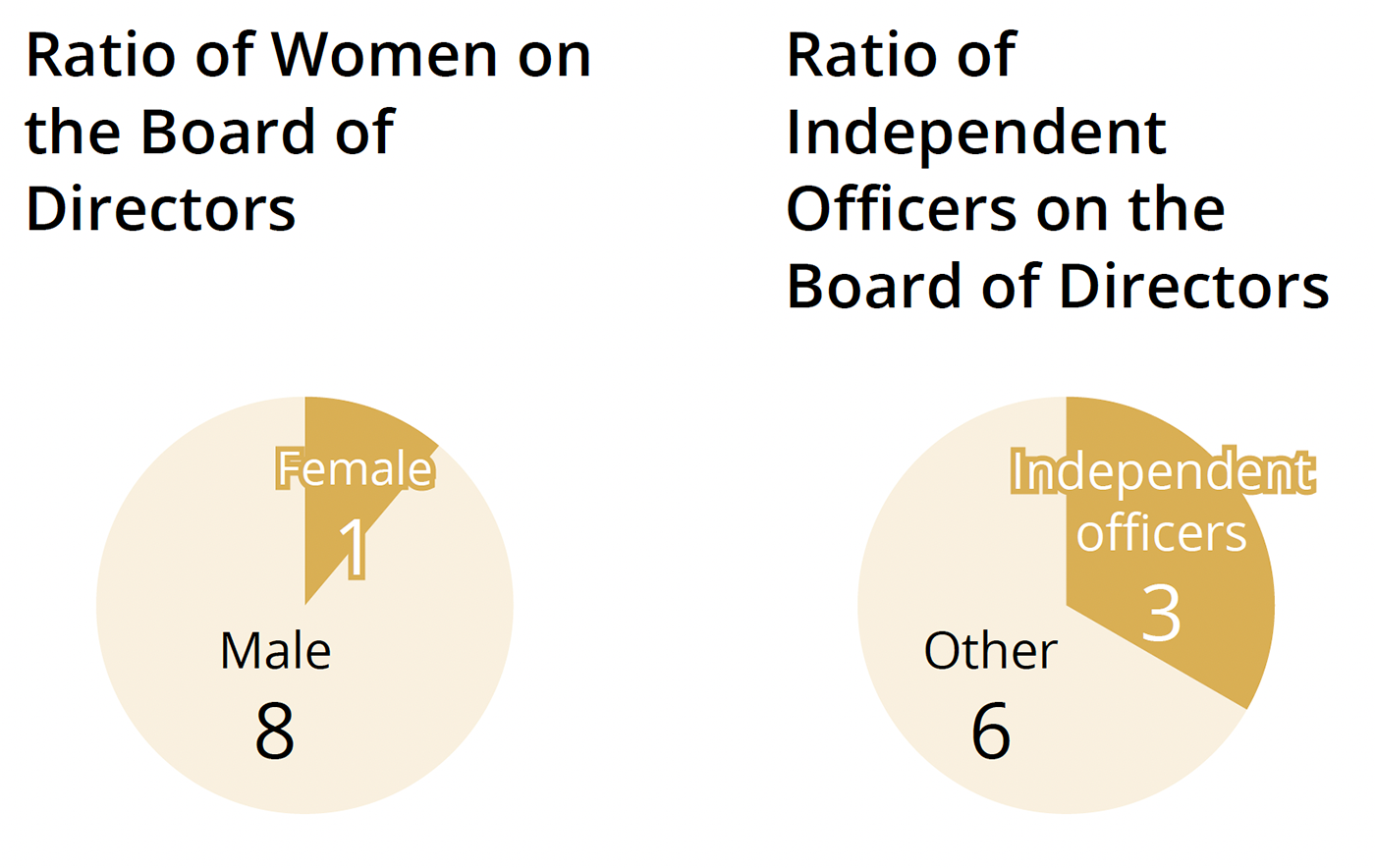

The Board of Directors consists of nine directors (eight men and one woman), including three outside directors, and its meetings are also attended by four Audit & Supervisory Board members, three of whom are outside Audit & Supervisory Board members.

Expertise and Experience of Directors

| Name | Position | Corporate Management and Business Strategy | Global Mindset | Sales and Marketing | Research and Development and Production | Quality Assurance and Safety and Environment | Financial Affairs, Accounting, and Finance | Human Resources and Labor | Legal Affairs, Compliance, and Sustainability |

|---|---|---|---|---|---|---|---|---|---|

| YAMADA Masao | Chairman and Representative Director | ● | ● | ● | ● | ● | ● | ||

| SEKIGUCHI Akira | President and Representative Director | ● | ● | ● | ● | ● | ● | ||

| TOBITA Minoru | Director | ● | ● | ● | ● | ||||

| SUGAWARA Akira | Director | ● | ● | ● | ● | ||||

| KATAGIRI Atsushi | Director | ● | ● | ● | ● | ● | |||

| HOSONO Hiroyuki | Director | ● | ● | ● | ● | ● | |||

| KOIZUMI Yoshiko | Outside Director | ● | ● | ● | |||||

| SATO Kimio | Outside Director | ● | ● | ● | ● | ● | |||

| SHIBAYAMA Atsushi | Outside Director | ● | ● | ● | ● |

Activities of the Board of Directors

We believe that at meetings of the Board of Directors there is a lively exchange of opinions during the deliberation of each proposal and regarding the supervision of the execution of business and that decision-making and supervision are conducted effectively. In addition, outside directors and outside Audit & Supervisory Board members also contribute by meeting regularly to exchange opinions.

Main Agendas

- Budgets, financial planning, and closing (monthly, quarterly, annual)

- Publicly disclosed materials (annual reports, governance reports, etc.)

- Remuneration system (introduction of restricted stock remuneration, individual compensation for directors)

- Subsidiary-related (additional investment, merger/dissolution, dissolution of business alliance, guarantees related to borrowings, etc.)

- Reorganization

- Valuation of cross-shareholdings

- Assessing board effectiveness

- Status of dialogue with shareholders (semi-annual)

- General Meeting of Shareholders (hosting and proposing agenda items)

- Results of voting rights exercised at the General Meeting of Shareholders

- Sustainability projects, etc.

Evaluation of the Effectiveness of the Board of Directors

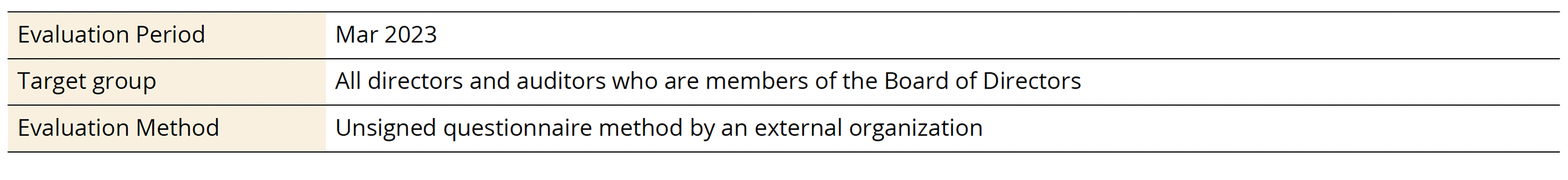

The Company conducts self-assessments and analyses of the effectiveness of its Board of Directors every year to improve its functioning and, ultimately, its corporate value. For self-assessment and analysis, the following methods were used with the advice of external organizations.

Overview of Effectiveness Assessment

Assessment Results

The Board of Directors will continue to work toward enhancing its functionality by giving thorough consideration and executing a response to the issues brought forth by this evaluation of its effectiveness.

The Audit & Supervisory Board

Composition and Activities of the Audit & Supervisory Board

The Audit & Supervisory Board of the Company comprises four members, also regarded as corporate auditors, one of whom has accounting and financial knowledge from working in the banking industry. In accordance with the audit policies and audit plans for the term stipulated by the Audit & Supervisory Board, members attend Board of Directors’ meetings and other important meetings and audit the execution of directors’ duties, such as reviewing status reports on such tasks from directors. They also monitor the independence of the independent accounting auditors and work with them to explain the audit plans of the independent accounting auditor and report audit findings.

Main Agenda

- [Resolutions]

- Annual audit plan, reappointment of the accounting auditor, consent for the accounting auditor’s audit fees, audit report of the Audit & Supervisory Board, consent to the proposal to appoint auditors, and consent to the comprehensive pre-agreement regarding the accounting auditor’s non-guaranteed services.

- [Reported Items]

- Reporting of audit implementation overview, communication, and reporting to non-executive auditors (Board of Directors meeting proposals, etc.)

- [Discussion and Deliberation Points]

- Exchange of opinions on annual audit plans, Board of Directors meeting proposals (including annual securities reports, internal control reports, corporate governance reports, etc.), confirmation of the contents of the accounting auditor’s audit report, etc.

Audits by the Audit & Supervisory Board

Full-time corporate auditors take the lead in conducting audits by visiting domestic and overseas subsidiaries in accordance with the audit plan formulated by the Audit & Supervisory Board. After reporting to and discussing with the Audit & Supervisory Board on matters discovered during on-site inspections of subsidiaries and the status of internal reporting, the final results are circulated to said subsidiaries and related officers. In FY 2022, the Audit & Supervisory Board conducted on-site inspections at a total of 46 locations.

Nominating Committee and Remuneration Committee

Composition and Activities of Nominating Committee and Remuneration Committee

The Company has established a Nominating Committee and a Remuneration Committee, both of which are voluntary committees. The executive remuneration system is designed with the advice of the Remuneration Committee. It incorporates objective perspectives such as the Group’s consolidated performance, the Company’s stock price, and external compensation levels. In addition, the Nominating Committee has been established to obtain objective advice on particularly important matters, such as the selection and dismissal of senior management. In principle, both committees are composed of at least five members. Most of them are outside directors, and the Board of Directors appoints the chairpersons of the committees. The committees meet several times a year.

Items for Consideration (Nominating Committee)

- Changes in directors and new management structure effective June 24, 2022

- Changes in directors and new Board of Directors effective April 1, 2023

- Regarding the skill matrix

Items for Consideration (Remuneration Committee)

- Appropriateness of remuneration for directors and corporate auditors for FY 2022

- Introduction of a restricted stock remuneration plan

Remuneration for Directors and Audit & Supervisory Board Members

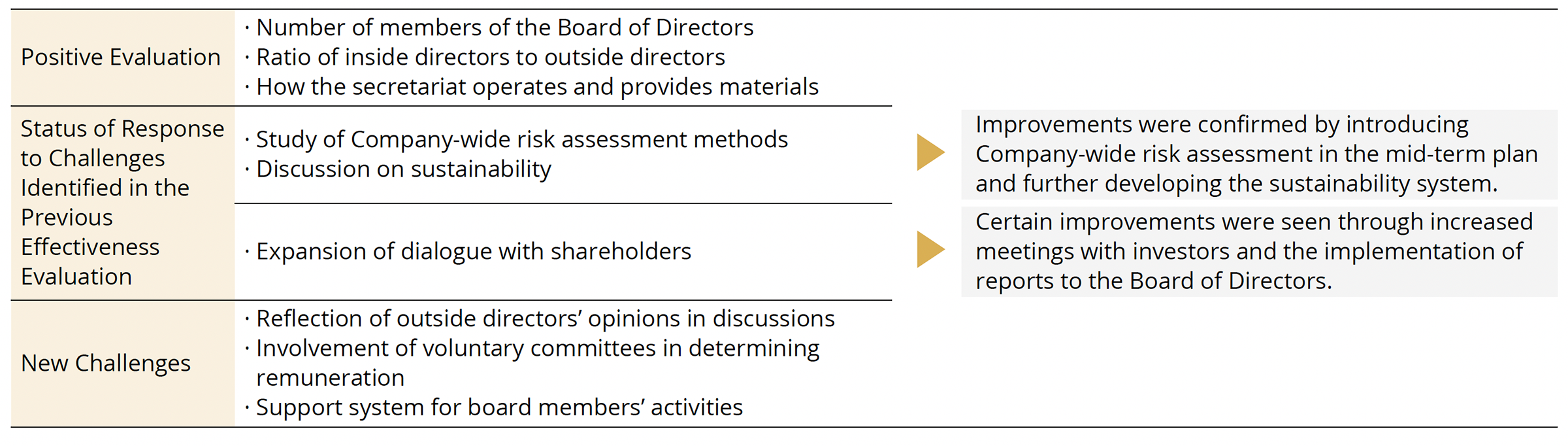

The remuneration system for directors comprises basic remuneration, which is a fixed amount; performance-based remuneration, which considers the Group’s consolidated performance; and restricted stock remuneration. This system has been designed with input from the Remuneration Committee. It is based on objective factors such as the Group’s consolidated performance, the stock price of the Company, and remuneration levels outside the Company. However, this system does not apply to outside directors as they take on a supervisory role from an independent and objective perspective. Therefore, they are ineligible for any remuneration based on individual performance. As each auditor is independent from the execution of business operations, only fixed remuneration is paid to each auditor. The amount of remuneration is determined through discussions among the auditors within the total remuneration approved by the General Meeting of Shareholders.

Composition of Remuneration for Directors

Remuneration Proportions

The ratio of basic remuneration, performance-based remuneration, and restricted stock remuneration that each director receives is determined by the President and Representative Director concerning a report by the Remuneration Committee, which is based on a benchmark of companies in the same business size and related industries and business categories as those of the Company. The President and Representative Director determines the remuneration details for each director per the calculation process established by the Remuneration Committee, which conducts a multifaceted review, including consistency with the decision-making policy established by the Board of Directors. This authority was delegated to the President and Representative Director since the Representative Director oversees the Company’s business operations, leading them to make the appropriate decisions. The Board of Directors also believes that the above involvement of the Remuneration Committee has allowed it to follow its policy of determining the remuneration details for each individual.

In addition, a clause (Malus clause) has been introduced for restricted share remuneration for directors, which stipulates that, in the event of serious misconduct or violations, shares shall be delivered to them. Restricted share remuneration has been introduced as medium- to long-term performance-linked remuneration for directors (excluding those outside the company) and executive officers, with the aim of providing an incentive to sustainably increase the company’s corporate value and to further promote value sharing with shareholders. The expiry date of the transfer restriction period under this system is at the time of retirement of the director or executive officer.

At the Annual General Meeting of Shareholders held on 24 June 2016, it was resolved that the maximum amount of remuneration to be paid to directors should not exceed JPY 570 million per year. At the conclusion of that Annual General Meeting of Shareholders, the number of directors was seven (including two outside directors). At the Annual General Meeting of Shareholders held on 28 June 2006, it was resolved that the maximum amount of remuneration to be paid to auditors should be no more than ¥ 100 million per year. At the conclusion of that Annual General Meeting of Shareholders, the number of auditors was four.

Policy about Remuneration for Directors and Audit & Supervisory Board Members

Basic Policy

The system of remuneration for directors has been designed with input from the Remuneration Committee and is based on objective factors such as the Group’s consolidated performance, the stock price of the Company, and remuneration levels outside the Company. Remuneration comprises basic remuneration, which is a fixed amount; performance-based remuneration, which takes into account the Group’s consolidated performance; and restricted stock remuneration. This system does not apply to outside directors, however, as they take on a supervisory role from an independent and objective perspective. Therefore, they are ineligible for any remuneration based on individual performance. The aforementioned Remuneration Committee is a voluntary committee that meets at least once a year, with the majority of its members coming from outside the Company as outside directors or outside experts.

Policy for Determining Amounts for Individual Basic Remuneration

Basic remuneration for directors is fixed remuneration paid monthly according to each director’s position and results. It is determined after a comprehensive examination that accounts for Company performance, remuneration levels at other companies, and employee salary levels.

Policy for Determining the Contents and Calculation Method for Performance-Based Remuneration

Performance-based remuneration is provided as a monetary payment paid at a certain time every year. The amount paid as performance-based remuneration is determined by using ordinary income as a baseline, which is then adjusted to reflect individual performance. The purpose of using ordinary income as an indicator for calculating performance-based remuneration is to link company profits to remuneration and thereby motivate directors to contribute to business growth.

Policy for Determining the Contents and Calculation Method for Restricted Stock Remuneration

Restricted stock remuneration shall be provided by granting monetary compensation claims to eligible directors based on a Board of Directors’ resolution. The directors will then pay these claims to the Company as a contribution in kind to receive shares of the Company’s common stock with restrictions on the transfer of these shares until retirement or resignation. The amount of each monetary compensation claim is determined according to the specific role of each director, and the amount to be paid per share is determined to be the closing share price of the Company’s common stock on the Tokyo Stock Exchange on the business day immediately preceding the date of the Board of Directors’ meeting in which a resolution will be made on the issuance or disposal of shares. The purpose of the restricted stock remuneration plan is to give eligible directors a medium- to long-term incentive to work toward the sustained improvement of the Company’s corporate value and to give shareholders and these directors a shared sense of value.

Internal Audit Department of DOWA Holdings

Composition and Activities of Internal Audit Department of DOWA Holdings

The Group’s internal audits consist of general Group audits conducted by the Internal Audit Department of DOWA Holdings (four members, including one concurrently serving in another department) and specialized operational audits conducted by each DOWA Holdings audit department and Group company. The main objectives of the Group-wide audit conducted by the Internal Audit Department of DOWA Holdings are to evaluate “internal control over financial reporting” based on the Financial Instruments and Exchange Act and assess the governance and risk management status at each Group company. In FY 2022, in addition to the “evaluation of internal control over financial reporting,” we focused on auditing the operational status of Company-wide integrated risk management. We made necessary evaluations, advice, and recommendations. The Internal Audit Department of DOWA Holdings holds regular meetings with corporate and accounting auditors to share information such as risk information and audit status. In addition, we report on the status of internal controls tothe Sustainability Subcommittee, which has jurisdiction over internal controls. Furthermore, audit results are regularly and directly reported to the Board of Directors and the Audit & Supervisory Board, mainly on the “evaluation of internal control over financial reporting.”

Internal Control Systems

The Company is building an internal control system based on the COSO Integrated Framework for Internal Control. In this context, we are promoting company-wide risk management (ERM) with reference to COSO and JISQ 2001 in order to prevent crises that could have a significant impact on management and minimise damage if they should occur. Specifically, we are strengthening and thoroughly implementing a series of risk management processes, including the identification of apparent and potential risks in each business activity, implementation of countermeasures, monitoring and auditing.

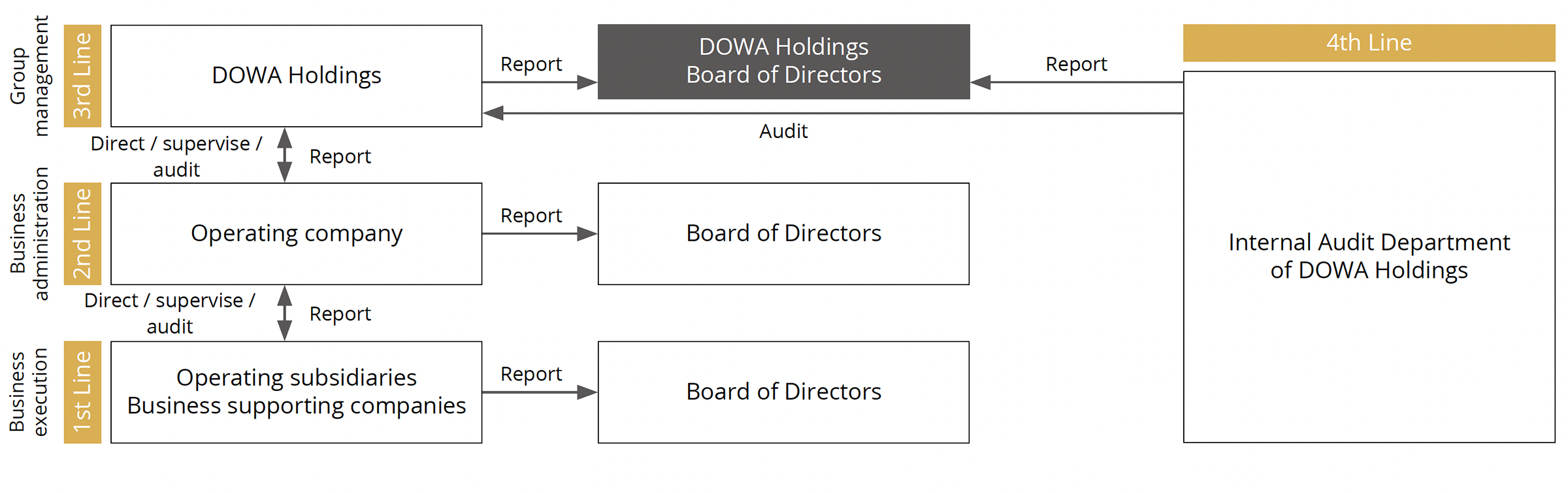

In response, the Company has adopted a holding company structure. While this raises the level of specialization of each business group and the speed at which policies can be executed, it also carries the risk that internal control systems will become localized and overall governance will suffer. To mitigate this risk and ensure internal control as a Group, we have shared our basic policy regarding internal control with each Group company and have developed the Four Lines Model, a model of internal control that works effectively within the holding company structure. Each line within the Four Lines Model plays a specific role in internal control. Under this model, the first line focuses on business execution, the second line focuses on business administration, the third line focuses on Group management, and the fourth line focuses on evaluating the Group’s internal control as a whole. Internal control systems must continuously be revised in line with changes in business activities and the social environment, so we are working to further strengthen these systems.

Accounting Auditor

The Company has been under an audit contract with Deloitte Touche Tohmatsu LLC (then Tohmatsu & Co.) since FY 1968. However, the Company has an audit contract with MISUZU Audit Corporation (then Tokyo Daiichi Certified Public Accountant Office) from FY 1968 to FY 2006. Due to the dissolution of MISUZU Audit Corporation, the Company entered into an audit contract with Deloitte Touche Tohmatsu LLC (then Tohmatsu & Co.) from FY 2007. In addition, the certified public accountant who had been auditing the Company transferred to Deloitte Touche Tohmatsu LLC and continued to perform auditing services for the Company after their transfer. Since this inherently means that the same audit firm is considered to have continued to perform audit services for the Company, the audit period of the audit firm before the transfer of the certified public accountant in question is combined.

In accordance with the provisions of the Certified Public Accountants Act, etc., the Company’s accounting auditors rotate periodically as follows.

- The first managing partner has not been involved in auditing services for more than five consecutive accounting periods.

- In principle, the managing partner has not been involved in audit work for more than seven consecutive accounting periods.

Initiatives

Reduction of Cross-Shareholdings

The Company positions its cross-shareholdings as those that will enhance the Company’s corporate value to maintain and strengthen relationships with business partners and other parties and form a strong relationship of trust with the issuing company. For each stock, the Board of Directors makes a comprehensive judgment as to whether or not to continue to hold the stock based on whether or not it meets the original purpose of holding the stock and whether or not the benefits and risks associated with holding the stock are commensurate with the cost of capital. The Board of Directors periodically reviews the details of such judgments. If it is determined that continuing to hold stock will not enhance corporate value, we will sell the shares in order, considering the impact on the market. In FY 2022, the Board of Directors examined the pros and cons of continuing to hold all listed shares held by the Group at a meeting held on December 9, 2022. As a result, we have decided to sell all of the shares of one stock held by the Company and all of the shares of one stock held by DOWA Metals & Mining Co., Ltd.

| Consolidated Overall Sales of Listed Shares | |

|---|---|

| FY2018 | Sold all shares of seven stocks held by the Company |

| FY2019 | Sold all shares of one stock held by the Company |

| FY2020 | Sold a portion of shares of one stock held by the Company |

| FY2021 | Sold all shares of one stock and a portion of shares of one stock held by the Company |

| FY2022 | Sold all shares of two stocks held by the Company (among which was the rest of the stocks of the stock the Company sold a portion of in FY 2020) |

Adoption of a Restricted Stock Remuneration Plan

On May 13, 2022, the Board of Directors of the Company passed a resolution to adopt a restricted stock remuneration plan for eligible directors (members of the Board of Directors who are not outside directors) and executive officers to incentivize them to improve the Company’s corporate value in a sustainable manner while increasing the value they share with shareholders. At the 119th Annual General Meeting of Shareholders, held June 24, 2022, the total amount of monetary compensation claims paid to the eligible directors to grant shares based on the plan was set at within ¥100 million per year, with the total number of common shares issued to be within 44,000 shares per year.

Initiatives to Strengthen Corporate Governance

| Board of Directors and Audit & Supervisory Board | Other | |

|---|---|---|

| FY2000 | Introduced executive officer system | |

| FY2003 | Reduced number of Board members from 20 to 15 and shortened directors’ terms of office from two years to one | |

| FY2006 | Reduced number of Board members from 15 to 13 | Moved to a holding company structure |

| FY2007 | Appointed one outside director | |

| FY2009 | Abolished hostile takeover defense measure | |

| FY2015 | Appointed one female outside director and updated governance structure to include two outside directors | Revised internal control systems |

| FY2017 | Introduced evaluation of Board of Directors’ effectiveness | |

| FY2018 | Verified decisions to continue or discontinue cross-shareholdings at Board meeting | |

| FY2019 | Established Nominating Committee | |

| FY2020 | Conducted an evaluation of Board effectiveness utilizing an external organization | Established Internal Audit Department |

| FY2021 | Appointed one outside director and updated governance structure to include three outside directors | |

| FY2022 | Expansion of reports to the Board of Directors on the status of dialogue with shareholders | Introduction of restricted stock remuneration Established Sustainability Committee |